Getting paid is great, but paying others? That can quickly become a relentless, soul-crushing deluge of invoices, receipts, and approvals. One minute. you’re managing a handful of vendors, the next, your finance team is playing Whac-A-Mole with overdue notices, drowning in an inbox full of emails with the subject line “bumping this.”

I’ve been there. I’ve seen the spreadsheets that stretch to infinity and beyond, the email chains for a single approval that rival a Tolstoy novel, and the sheer dread of month-end close. That’s why I set out to find the absolute best accounts payable software. I wanted to find the tools that actually deliver on their promise to streamline all that stuff they promise to streamline and help you and your team reclaim time, enhance accuracy, and give you crystal clear control over your outgoing cash.

With that, let’s dive into the top accounts payable software available today.

The 9 best accounts payable tools

-

QuickBooks Enterprise for accounting with strong AP

-

Ramp for unified spend management and ease of use

-

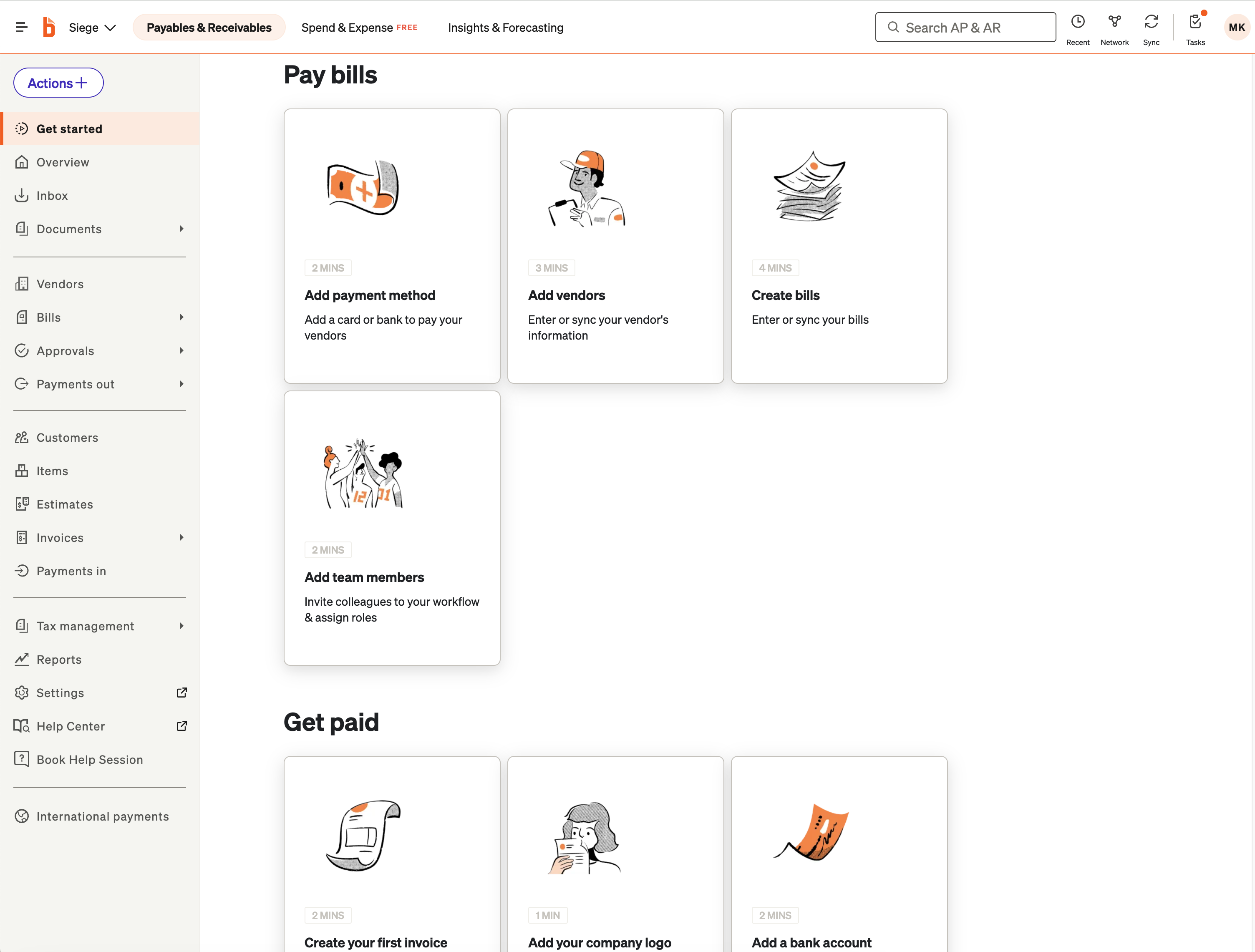

BILL AP/AR for small and midsize businesses (SMBs)

-

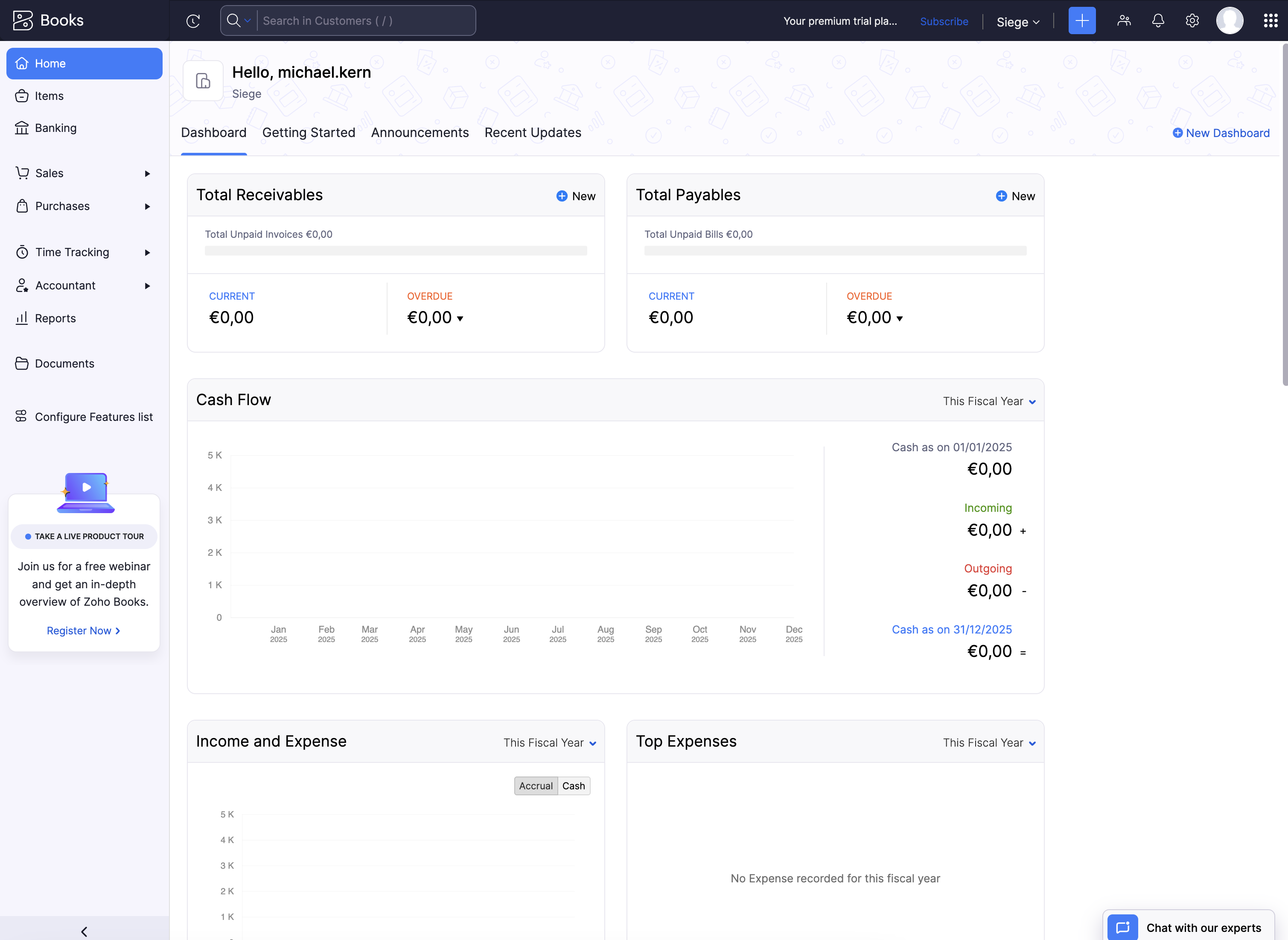

Zoho Books for integrated accounting with dedicated AP

-

Stampli for hands-on control and invoice approval

-

DOKKA for AI-driven invoice automation

-

Tipalti for global payables and mass vendor management

-

NetSuite for a comprehensive ERP with advanced AP

-

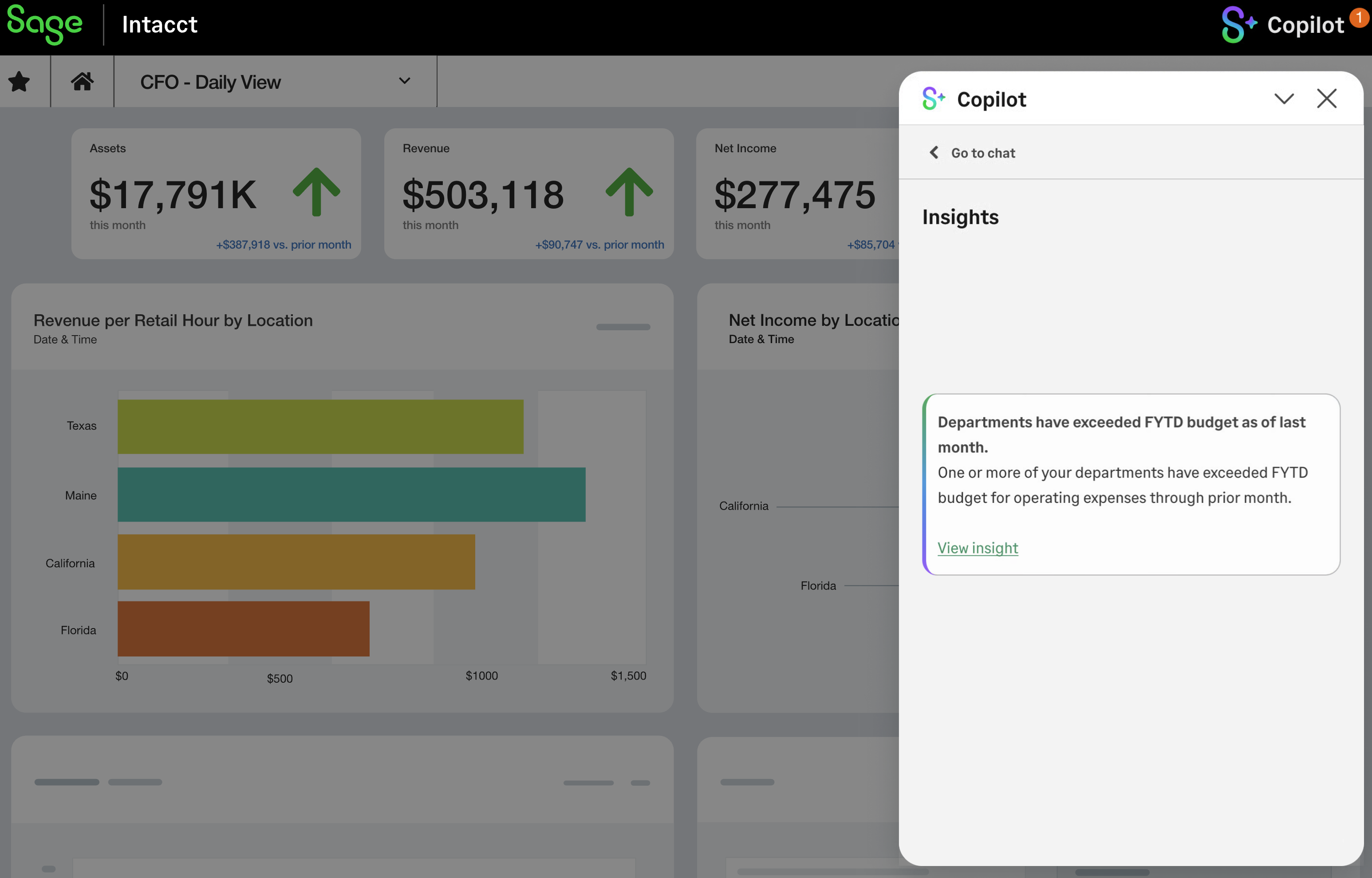

Sage Intacct for deep accounting capabilities

What makes the best accounts payable solution?

How we evaluate and test apps

Our best apps roundups are written by humans who’ve spent much of their careers using, testing, and writing about software. Unless explicitly stated, we spend dozens of hours researching and testing apps, using each app as it’s intended to be used and evaluating it against the criteria we set for the category. We’re never paid for placement in our articles from any app or for links to any site—we value the trust readers put in us to offer authentic evaluations of the categories and apps we review. For more details on our process, read the full rundown of how we select apps to feature on the Zapier blog.

There’s no one single best AP automation software. That’s because every business has different objectives. A small startup still managing a few dozen invoices manually, for example, needs different features and scalability than a rapidly growing enterprise processing hundreds (or thousands) of invoices across multiple departments. One size definitely does not fit all in this world.

To find the best platforms, I dove deep into product demos, meticulously reviewed user feedback on trusted sites, and analyzed how each system grappled with common AP headaches. I wanted to see them in action, imagine myself actually using them day-to-day, and pinpoint what really made the AP process smoother. As I evaluated, I considered:

-

Streamlined invoice processing: This is the core promise of AP automation software and, as such, I looked for robust capabilities to capture, validate, and process invoices with minimal human intervention. This meant looking for sharp optical character recognition (OCR) for accurate data extraction, strong automated three-way matching (to ensure the PO, receipt, and invoice are playing nicely), and intelligent routing rules for approvals.

-

Seamless integration with existing systems: I heavily weighted how well each solution integrated with existing enterprise resource planning (ERP) systems and popular accounting software. The goal here is to ensure data consistency, avoid infuriating duplicate entries, and provide a unified view of your financial operations. After all, a powerful AP tool shouldn’t be an island.

-

Robust workflow automation and approval management: Chasing approvals via email is a special kind of purgatory. I focused on solutions that offer advanced, configurable workflow automation for approvals. Can you set up clear approval hierarchies? Will it send automated notifications and gentle (or firm, depending on your needs) reminders? Can key stakeholders approve invoices from anywhere, even their mobile devices? This isn’t just about speed; it’s about clear accountability and slashing approval cycles.

-

Comprehensive reporting and analytics: I looked for strong reporting and analytics capabilities that go beyond basic lists because, without good data, you’re flying blind. This meant customizable dashboards, real-time insights into invoice status, clear spending trends, and visibility into vendor performance.

-

Enhanced security and compliance: We’re dealing with money here, so security is paramount. Features like role-based access control (so only the right eyes see the sensitive stuff), detailed audit trails (for when you need to know exactly who did what and when), and strong data encryption are absolute necessities. Crucially, I considered how well the software helps you adhere to relevant financial regulations (like SOX or GDPR).

-

Intuitive user experience (UX) and ease of adoption: The most feature-rich software is useless if it’s a nightmare to learn or use daily. You need a well-designed user interface that minimizes the learning curve, making it simpler for new users to get started without a three-day training seminar. For experienced users, it should allow them to navigate complex tasks efficiently, not through a maze of clunky menus.

Now, an important note before we dive into the specific tools: expect a real investment for a comprehensive solution. Not only financially. Implementation often requires more planning than simply downloading an app, sometimes involving integrations with your existing systems and careful setup to match your unique workflows. It’s not always plug and play, but the payoff in efficiency is usually well worth the effort.

The best AP software at a glance

|

Best for |

Standout feature |

Pricing |

|

|---|---|---|---|

|

Comprehensive accounting with strong AP |

Scalable accounting tools with robust AP features within a full ERP ecosystem |

From $2,210/year |

|

|

Unified spend management and ease of use |

AI-driven automation across corporate cards, expense, and bill pay, with an exceptionally user-friendly interface |

Free plan available; paid plans from $15/user/month |

|

|

Small and midsize businesses |

Automates bill, invoice, and payment processing with strong accounting software sync |

From $45/user/month |

|

|

Integrated SMB accounting |

Comprehensive accounting with a seamlessly integrated, robust dedicated AP module |

Free plan available; from $15/month/organization |

|

|

Hands-on control and invoice approval |

User-friendly invoice management platform that connects every dot from request to reconciliation |

Contact for pricing |

|

|

AI-driven invoice automation |

Transforms finance with intelligent, AI-powered invoice processing for data extraction and categorization |

Contact for pricing |

|

|

Global payables and mass vendor management |

Automates end-to-end payables and global payments, handling tax forms and compliance across countries |

From $99/month |

|

|

Comprehensive ERP with advanced AP |

Fully integrated cloud ERP suite with extensive, well-regarded AP automation features for mid-market to enterprise |

Contact for pricing |

|

|

Deep accounting capabilities |

Flexible and scalable financial platform excelling in robust reporting and customizable dashboards for accounting |

Contact for pricing |

Best accounts payable software for comprehensive accounting with strong AP

QuickBooks Enterprise (Windows, Web, iOS, Android)

QuickBooks Enterprise pros:

-

Robust AP automation

-

Deep QuickBooks ecosystem integration

-

Customizable approval workflows

-

Extensive reporting and scalability

-

Enterprise-grade security and compliance

QuickBooks Enterprise cons:

For many businesses, QuickBooks Enterprise is their financial command center, handling the ledger, vendor lists, and cutting checks. And for that core accounting work, it’s solid. But if you’re picturing a seamless, automated AP process right out of the box, you might need to adjust your expectations. This is the reliable, trusty old sedan in your garage. It gets you from A to B, but it’s not going to win any races in the intelligent automation arena without some serious modifications.

When I think about tackling invoice volume with just QuickBooks Enterprise, I immediately picture someone hunched over a keyboard, manually typing in every line item. There’s no magical scan that reads your invoices, and getting purchase orders to match up perfectly with bills is definitely a manual exercise. And if you’re trying to get approvals from multiple people, prepare for a lot of “Did you see my email?” follow-ups. That kind of approval routing just isn’t built into its DNA.

Security is foundational here, with solid user permissions and a clear history of who did what. But for tighter controls like specific role-based access or catching sneaky duplicate payments, those come from the dedicated AP apps you bolt on. So, while the feel of QuickBooks Enterprise is familiar and generally easy for existing users, the initial learning curve for setting up and mastering these integrated workflows can still feel pretty steep. The actual experience of automated AP hinges entirely on the ecosystem you build around it.

While QuickBooks Enterprise is a powerful desktop platform for core accounting, getting its data to play nicely with other apps in your wider tech stack can sometimes feel like building custom bridges. Its cloud counterpart, QuickBooks Online, has a vast ecosystem of direct integrations, but for Enterprise, you’ll often rely on the integrations of additional specialized AP tools.

This is where Zapier can bridge the gap, letting you connect QuickBooks to thousands of other apps, so you can have better cross-platform visibility, greater data accuracy, and more space for priority work. Learn more about how to automate QuickBooks, or get started with one of these pre-made workflows.

QuickBooks Enterprise pricing: From $2,210/year for Gold (up to 30 users); higher tiers and more users will cost more

Best accounts payable software for unified spend management and ease of use

Ramp (Web, iOS, Android)

Ramp pros:

-

AI-driven AP automation and expense management

-

Extensive integration with 200+ apps

-

Robust multi-level approvals and controls

-

Real-time spend insights and reporting

-

Affordable upgrade

Ramp cons:

Imagine pulling together corporate cards, expense reports, purchasing, and all your accounts payable into one sleek dashboard. That’s Ramp. It’s a truly modern finance platform that uses AI not just to manage spend, but to intelligently understand and control it. For finance pros weary of jumping between a dozen different tools, this feels like a breath of fresh air.

I remember setting up a similar system years ago by piecing together separate solutions, and it was a headache. Ramp cuts through that. The interface is incredibly clean. It almost feels like a consumer app, which is a rare compliment for finance software. You don’t get lost, and tasks are surprisingly intuitive.

When invoices come in, Ramp’s pretty smart about it. Its AI-powered scanning can quickly pull structured data off invoices with impressive accuracy, cutting down on manual keying errors. It even tries to auto-categorize expenses, learning from your past behavior, which saves a surprising amount of time.

Connecting Ramp to your existing accounting software usually goes off without a hitch. It’s built to keep that vendor list and chart of accounts perfectly in sync, so you’re not wrestling with data discrepancies or duplicate entries. That shared truth between systems is invaluable.

It handles approvals really well, too. You can set up exactly how you want invoices routed—maybe based on the amount, who the vendor is, or what department is spending the money. It’ll send out automated pings to the right people, and they can approve things right from their phone. This makes getting a sign-off way less painful than the old email chase.

For getting a handle on your cash flow, Ramp offers excellent real-time dashboards. You can see exactly what’s owed and what’s been spent and spot spending trends without pulling multiple reports. It’s the kind of visibility that helps you make faster, smarter financial decisions.

So what’s the downside? Because Ramp is so focused on consolidating all spend, it might not have the hyper-specialized depth for very niche AP needs like complex, multi-layered five-way invoice matching for highly specific manufacturing processes, compared to a pure-play legacy AP solution. It’s built for broad, intelligent spend control.

Also, while the core features are free, getting access to some of the more advanced features and deeper integrations might require an upgrade to Ramp Plus. This makes it an ideal fit for modern, fast-growing businesses that prioritize real-time visibility, automated control across all spend categories, and a sleek user experience. It’s for teams who are tired of fragmented finance systems and want a single source of truth.

Ramp pricing: Free for core corporate card and expense management; from $15/user/month for Ramp Plus; enterprise pricing is custom.

Best accounts payable software for small and midsize businesses

BILL (Web, iOS, Android)

BILL AP/AR pros:

-

Robust bill/invoice processing and automation

-

Excellent sync with accounting software

-

Intuitive, user-friendly interface

-

Comprehensive financial operations platform

BILL AP/AR cons:

BILL is an absolute workhorse for processing and paying invoices and managing receivables. If your primary headache is moving bills through approvals at lightning speed and handling payments, this is the software you’re looking for.

But let’s be real: your business isn’t just about invoices or payments. You’ve got sales teams in a CRM, project managers tracking tasks, HR onboarding new hires, and marketing teams running campaigns. All these departments need to stay in the loop, and if your AP/AR tool can’t talk to them, you’re back to manual data entry and email updates.

This is where BILL really steps up as an ecosystem expander. Its built-in bridges to major accounting and ERP systems like QuickBooks, NetSuite, and Xero are solid. They ensure data consistency between your core financial ledger and your payment processes, so your vendor lists and general ledger accounts are always in sync (two-way sync, in fact). This handles a big chunk of the integration puzzle right out of the box.

The unified operational picture you get from this expanded ecosystem is incredibly powerful. You move beyond just efficient AP/AR to having a more synchronized business. There’s less manual copy-pasting, fewer missed updates, and your teams work with more current information.

While setting up a comprehensive ecosystem requires some thought and initial configuration, the day-to-day experience of having your payment processes integrated into your broader operations is a massive time-saver. You’ll find BILL’s core interface generally intuitive, making managing bills and payments quite manageable within this interconnected environment.

BILL AP/AR pricing: From $45/user/month for Essentials; from $79/user/month for Corporate

Best accounts payable software for integrated SMB accounting with dedicated AP

Zoho Books (Web, iOS, Android)

Zoho Books pros:

Zoho Books cons:

For small and medium businesses, “integrated finance platform” often just means a bunch of expensive, overly complex software you barely use. But Zoho Books, especially when paired with Zoho Spend, offers a surprisingly cohesive and affordable solution for your accounting and basic spend management needs without the enterprise-level overhead.

How does it work in practice? Zoho Books handles your fundamental AP needs: entering bills, tracking vendors, and processing payments. It’s intuitive enough for most small business owners or finance teams. Zoho Spend brings more muscle to your spend control right at the source. You can upload receipts and bills, and it uses OCR to pull out the key information, saving you from tedious manual typing. It also helps with basic matching against purchase orders, ensuring you’re paying for what you actually ordered. This combination helps you avoid the headache of separate, disconnected spreadsheets for spend tracking.

These features solve a classic small business pain point: trying to manage bills and expenses across disparate systems, which inevitably leads to missed invoices, reconciliation nightmares, and a foggy picture of your cash flow. By having these tools talk to each other, you get better data consistency and a more unified view of your financials. For approvals, Zoho Spend lets you set up customizable workflows for purchases and expenses, so requests go to the right people with automated alerts.

While Zoho’s core integrations are strong within its own ecosystem, if you need to pull data from a very specific external CRM or project management tool into Zoho Books for AP context, you’ll need additional integrations via Zapier. Then you can create fully automated, AI-powered systems for accounts payable. Here are a few workflows to get you started.

Zoho Books pricing: Free for basic features; from $15/month/organization for the Standard plan; up to $60/month/organization for the Premium plan

Best accounts payable software for hands-on control and invoice approval

Stampli (Web, iOS, Android)

Stampli pros:

-

User-friendly invoice management

-

Seamless accounting system integrations

-

Efficient, transparent approvals

-

Comprehensive procure-to-pay functionality

Stampli cons:

Stampli touts being built by AP professionals, and after seeing it in action, I’d say that really rings true. It’s an AP automation platform that focuses heavily on making invoice processing smooth and, crucially, making it easy for everyone to talk about a particular invoice without endless email chains.

I’ve definitely experienced the frustration of chasing down approvals or trying to figure out why an invoice is stuck. Stampli seems designed to solve those specific annoyances by integrating invoice-based workflows fluidly across roles.

When invoices land in Stampli, it’s pretty impressive. It uses AI-powered technology to extract data from them, so you’re not manually keying in details. It’s smart enough to handle two- and three-way matching against purchase orders, and it has clever rules to get invoices to the right approver quickly. The idea is to have very little human touch on the invoice itself.

Its approval workflows are a core strength. Stampli offers highly adaptable and dynamic rules for who approves what, with clear hierarchies. But the real game-changer is the ability to have discussions directly on the invoice. No more hunting through email threads. People get automated alerts, and they can approve things right from their phone, which massively speeds up the process.

Connecting Stampli to your ERP is usually pretty painless. It’s built for constant data synchronization, meaning your vendor lists and general ledger codes stay consistent, and you avoid those annoying duplicate entries between systems.

For keeping tabs on your AP, Stampli offers helpful dashboards and reports. You can see the status of every invoice, get real-time insights into your business processes, and identify spending trends.

Security is also well-covered. There’s a complete audit trail of every single action, strong role-based access controls to protect sensitive data, and features to prevent things like duplicate payments. Reviewers consistently mention that Stampli’s interface is intuitive and easy to learn, which is a big plus for getting teams on board quickly.

Stampli pricing: Contact for pricing

Best accounts payable software for AI-driven invoice automation

DOKKA (Web, iOS, Android)

DOKKA pros:

-

Automates invoice data extraction and categorization

-

Integrates with major ERPs (NetSuite, SAP, Microsoft Dynamics 365) and accounting software

-

Automates two- and three-way PO matching

-

User-friendly interface, similar to email apps

DOKKA cons:

DOKKA is an AI-focused accounts payable automation tool, and it immediately struck me as a tool that genuinely wants to take the pain out of handling financial documents. It’s less about the overarching ERP and more about making sure the data that enters your system is as clean, accurate, and categorized as possible from the very start. Think of it as a highly diligent digital assistant whose sole purpose is to make your bookkeeping life less manual and more precise.

When I picture the manual process of pulling data from varied receipts, invoices, and statements, I immediately see hours of tedious typing and the inevitable risk of typos. DOKKA’s core strength bypasses this. It uses sophisticated OCR technology combined with machine learning to swiftly and accurately extract data from any financial document. It’s pretty smart, going beyond just reading text to suggest categorizations and GL codes, learning from your behavior over time. This kind of automated intelligence really cuts down on the initial grind of invoice capture and coding.

Its focus on data accuracy has a significant ripple effect. By ensuring the data entering your system is precise, it helps prevent errors that might otherwise propagate through your accounting software. DOKKA also provides customizable workflows for documents, allowing for easy collaboration and routing for approvals, so bills don’t get stuck. Its integrations with popular accounting software are designed for smooth data transfers, ensuring data consistency and avoiding redundant entries in your core ledger.

For reporting, DOKKA aims to provide real-time financial updates, meaning your financial picture is always current, rather than lagging behind manual processes. You can get insights into the status of your invoices and how efficiently your document processing is running. Security-wise, it’s built with modern safeguards, including data encryption for sensitive information, secure authentication, a detailed audit trail of all actions, and role-based access control to ensure only authorized eyes see your financial data.

DOKKA pricing: Contact for pricing

Best accounts payable software for global payables and mass vendor management

Tipalti (Web, iOS, Android)

Tipalti pros:

-

Automates end-to-end global payables and mass payments

-

Seamless vendor onboarding and management

-

Handles tax forms, AML, and OFAC screening automatically

-

User-friendly interface

Tipalti cons:

If your business is growing and suddenly you’re dealing with hundreds or thousands of suppliers spread across different countries, making payments can quickly become a nightmare. Different currencies, tax regulations, bank fees, chasing W-9s or W-8s—it’s a special kind of headache. That’s where Tipalti shines. It’s an end-to-end global payables automation platform that simplifies this entire complex web, from the moment you onboard a new supplier to the final payment landing in their account.

When I think about the sheer logistical challenge of paying international vendors manually, I can feel the stress. Tipalti steps in to handle that entire workflow. It starts with a smart supplier onboarding portal that collects all necessary information and tax documents, ensuring compliance right from the get-go.

For invoice processing, Tipalti uses AI-driven OCR to capture invoice data, and it’s pretty astute at two- or three-way matching against purchase orders. It’s also built to proactively detect duplicate bills, which is a fantastic safety net against accidental overpayments. The platform then manages global payments in various methods and currencies, handling the complexities so you don’t have to.

Its approval workflows are highly customizable, allowing you to set up multi-dimensional rules and approval hierarchies. Automated notifications keep things moving, and mobile approval capabilities mean your team can sign off from anywhere. Tipalti also connects seamlessly with major ERP systems like QuickBooks, NetSuite, and Sage Intacct, ensuring real-time data synchronization and consistency.

You get really strong reporting and analytics here, too. You can track payment statuses, review detailed audit trails, and use an AI Report Builder to create custom dashboards. These features give you deep insights into invoice status, spending habits, and vendor performance, empowering data-driven optimization.

When it comes to security and compliance, Tipalti features a KPMG-approved tax compliance engine, advanced payment fraud detection (using AI to spot anomalies), robust role-based access control, and enterprise-grade data encryption. All of these, combined with comprehensive audit trails, are vital for regulatory adherence. Users generally find Tipalti’s interface straightforward, and its self-service supplier portal significantly improves the onboarding experience for vendors.

Tipalti pricing: From $99/month for the Starter tier (user count not specified); contact sales for custom quotes beyond the Starter tier

Best accounts payable software for a comprehensive ERP with advanced AP

NetSuite (Web, iOS, Android)

NetSuite pros:

-

AI/ML/OCR invoice capture, two- and three-way matching, automated approvals

-

Deep native integrations within its ERP suite

-

Customizable approval workflows with routing/escalations

-

Extensive, real-time reporting and analytics across all modules

-

Enterprise-grade security and SOX compliance support

NetSuite cons:

ERP systems often get a bad rap for being clunky, complex, and a bear to implement. And while NetSuite is certainly complex due to its sheer breadth, when it comes to accounts payable, its integrated nature actually flips the script. Instead of being an isolated AP tool, it brings your payables into a complete financial and operational picture in a way that very few others can. It’s like having your AP team, purchasing, and general ledger all sitting at the same table, working from the same sheet of music.

Within NetSuite, invoice processing isn’t just about the invoice itself; it’s inherently tied to purchasing orders and receipts. It excels at three-way matching, ensuring that what you’re paying for actually matches what you ordered and received. All your vendor records are centralized, which makes tracking everything much easier and aims to eliminate those pesky manual errors.

The big win here is how this integration solves major pain points. You avoid data silos that plague businesses using disconnected systems. Your financial data is inherently consistent, reducing reconciliation headaches. For approvals, NetSuite’s SuiteFlow engine allows for deep workflow customization so you can set up complex approval hierarchies based on any criteria, get automated notifications, and even approve payments from your mobile device. This level of control, integrated directly with your general ledger and cash management, gives large organizations unmatched financial oversight and helps ensure SOX compliance.

As a full ERP, NetSuite provides extensive capabilities across all financial data for reporting and analytics. You get real-time views of cash outflows, spending trends, and vendor performance through highly customizable dashboards you can drill down into.

Need to expand AP functionality into other applications beyond the NetSuite suite? Zapier has a NetSuite integration that allows you to orchestrate all your workflows and add AI to the mix when you need it. This means you can extend the data beyond the finance team to operational users. Learn more about how to automate NetSuite, or get started with one of these examples.

While the initial learning curve for NetSuite can be steep due to its vastness, the payoff in terms of integrated financial control and the ability to manage AP as part of a cohesive enterprise system is substantial for larger organizations.

NetSuite pricing: Contact for pricing

Best accounts payable software for deep accounting capabilities

Sage Intacct (Web, on-premise)

Sage Intacct pros:

-

Robust accounting and financial solutions

-

Flexible and scalable financial platform

-

Customizable dashboards and intelligent approval routing

-

Extensive reporting tools

Sage Intacct cons:

Remember when your accounts payable reports were just lists of what you owed? Getting truly granular insights into spending by department, project, or entity felt like pulling teeth, often requiring endless spreadsheet exports and manual manipulation. It was a chore, not a source of strategic information, leaving you guessing about where your money was actually going.

Sage Intacct is the opposite of that. Instead of simple bill entry, the platform pushes for high “touchless processing” rates. It helps with invoice capture (often through integrated modules) and robust three-way matching against purchase orders and receipts. The intelligence behind it ensures accuracy from the start.

But where it really shines is after the data is in. Its core strength lies in its advanced reporting capabilities. You get dynamic, customizable dashboards that go far beyond basic lists. You can drill down into spending by almost any dimension—department, project, vendor—giving you real-time insights into spending trends and invoice status that you simply couldn’t get before without serious manual effort.

The ripple effect of this dimensional data is massive. Your dashboards become dynamic, allowing you to slice and dice AP spending by any dimension you’ve set up, giving you real-time insights into spending trends that basic systems can’t touch. This elevates AP from a transactional process to a strategic asset. You can quickly see actual spend against budget for a specific project, assess vendor costs per business line, and understand departmental expenditures in unprecedented detail. This can improve financial control, data-driven decisions, and help with compliance (with detailed audit trails and role-based access control).

Once Sage Intacct has generated these dimensional financial insights, you can amplify their intelligence across third-party tools with Zapier’s Sage Intacct integration. If a new invoice is posted to a specific dimension, you can instantly push that spending data to a marketing budget tracking tool, or notify the marketing lead in Slack with the updated budget burn. To see more possibilities, check out these other pre-built automations.

Sage Intacct pricing: Contact for pricing

Orchestrate your accounts payable workflows with Zapier

While this isn’t an exhaustive list of every automation-powered AP tool out there, it should give you a solid roadmap. The common thread among the best solutions is their ability to take the drudgery out of accounts payable, freeing up your team for more strategic work.

Even the most robust AP software gets better when it’s seamlessly connected to your broader tech stack. Zapier can bridge the gaps between 8,000+ apps, unlocking truly integrated and automated workflows that unify your operations.

Related reading: