For many freelancers, small business owners, and agencies, the dream setup is one where you can focus entirely on delivering great work without constantly managing invoices, chasing payments, or worrying about accounting deadlines. But the reality is, financial admin will need your attention at some point.

Even with tools like FreshBooks to help manage invoicing and expenses, many of the day-to-day tasks—like creating invoices, updating client records, and tracking payments—still require lots of manual effort. And as your business grows, these tasks pile up, eat into your billable hours, and pull you away from high-value client work. Thankfully, automation can help.

With Zapier’s automated workflows (called Zaps), you can connect FreshBooks to your business-critical apps and create powerful systems that automate all of your financial admin workflows. Here are some of the most popular ways to automate FreshBooks.

New to Zapier? It’s workflow automation software that lets you focus on what matters. Combine user interfaces, data tables, and logic with thousands of apps to build and automate anything you can imagine. Sign up for free to use this app, and thousands more, with Zapier.

Table of contents

Automatically create FreshBooks clients and invoices

Let’s say a new client fills out a form on your website to book your service. Their info enters whichever form tool you use. Your next step is to transfer their details into FreshBooks, create a client profile, and maybe draft an invoice—before you even start working with them. If business is picking up and leads are coming in regularly, this manual process can quickly become a bottleneck. Instead of exporting each form submission and entering the details by hand, you can automate the whole workflow, so it runs in the background while you focus on your clients.

For instance, you can set up a Zap that creates a new client or invoice in FreshBooks whenever there’s a new submission in Typeform, Jotform, or Wufoo. The workflow transfers all the client’s details accurately—no missed fields or mistakes. If you’re capturing new clients in a spreadsheet or HubSpot, the Zap can send those details into FreshBooks whenever a new row is added or a record is updated.

With this setup, your admin stays up to date without slowing you down, while client onboarding stays smooth and consistent no matter how busy things get.

Connect payments and financial records automatically

If you offer multiple payment options—like Stripe, PayPal, Square, or Shopify—you need a reliable way to track every transaction. It’s the only way to get a clear view of your business’s financial health and stay compliant come tax time.

While you can enter those payments into FreshBooks manually, things can get messy fast. It’s all too easy to mistype a number, miss a transaction, or forget to log a payment altogether. Save yourself the headache by using automation to handle the process.

With the Zaps below, you can automatically create expense or income records in FreshBooks every time you receive a payment through Stripe, PayPal, Square, or Shopify. It’s a simple way to keep your books accurate without extra effort. You can even use the Zaps to generate and send out new FreshBooks invoices whenever an order is placed in WooCommerce.

Send notifications for updated invoices and estimates

A big part of staying on top of your business’s finances is knowing when things change—like when an invoice gets paid or an estimate is updated. If everyone’s informed on time, the right team member can react quickly and keep work moving without delay.

Of course, you can block out time to check FreshBooks at intervals and then share updates with your team, but that approach doesn’t scale. It breaks your focus and creates space for human error. A better way is to set up automated alerts using Zaps to keep everyone in the loop without lifting a finger.

For instance, when a client pays an invoice in FreshBooks or updates an estimate, automation can send a message in Slack or Discord. You can specify the details you want included in the message and the channel you want it shared in. You can also set up the Zap to send payment confirmation and financial updates via email if that’s your preferred communication channel.

With automated alerts, you’ll never miss a beat, and your team can act fast without constantly checking for updates.

Track your finances in a spreadsheet or database

Many small teams and solo business owners rely on tools like Google Sheets, Notion, or Airtable to track revenue and expenses. These platforms often serve as a central dashboard, giving you a full view of the business at a glance. Plus, they’re great for backing up your data, too, just in case.

But for those records to be useful, the data needs to stay current and accurate. And if you’re manually shuttling information from FreshBooks into your database, you risk introducing errors or overlooking updates, which can compromise your records.

With the Zaps below, you can connect FreshBooks to your spreadsheet, Notion workspace, or Airtable base and shed the responsibility of moving data yourself. So whenever a new invoice or expense is noted in FreshBooks, a matching entry will appear in your preferred tool. It’s a scalable way to keep your records in sync even as your business grows.

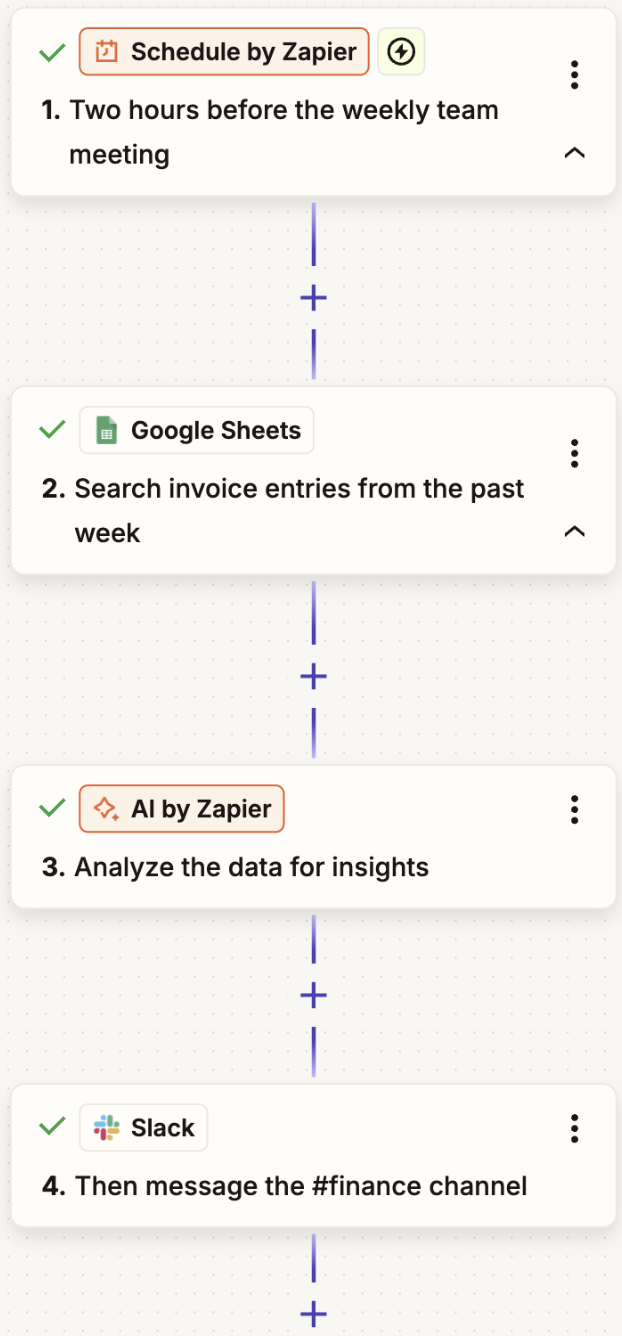

Pro tip: Use AI to automatically surface insights from your spreadsheet. For example, you can ask AI to analyze client invoices for trends, outliers, and overdue payments, then send those insights to a dedicated Slack channel ahead of the finance team’s weekly meeting. Read our guide to using our built-in AI tool, AI by Zapier.

Create follow-up tasks from FreshBooks

You’ve just sent an invoice to kick off a new project—congrats! So what’s next? Maybe you need to follow up with the client, or your team needs to get started right away. Either way, someone needs to take the next step, often by creating follow-up tasks in your project management tool.

You could do this manually—adding to-dos in Todoist or creating new boards in Monday.com —but again, that could lead to delays or missed details, especially when you’re managing a handful of clients.

Instead, use automation to smooth out the handoff between finance and operations. For instance, when a new project is added in FreshBooks, a Zap can automatically create a matching project in Asana or Todoist. Similarly, if you send out an estimate, you can use these workflows to create a task in ClickUp, so your team knows to follow up.

Use automation to simplify your finances and scale your operations

FreshBooks helps you handle your invoicing, expenses, and client management. But when you connect it to the rest of your business-critical tools, you unlock even more value. With Zapier, every new client, payment, or project update can instantly show up in your spreadsheet, task manager, or Slack channel without any extra work from you.

And this is just the start of what you can do with Zapier and FreshBooks. What will you automate first?